Blog

Essential Tools and Software for Professional Tax Service Businesses

Here’s a detailed look at some essential tools and software that can make a significant…

The Ethics of Tax Preparation: Navigating Ethical Dilemmas and Maintaining Integrity

The following article explores common ethical issues in tax preparation and offers guidance how to…

The Blueprint for Tax Office Success: Essential Steps for New Entrepreneurs

Starting a tax business can be a rewarding venture for those with a passion for…

A Guide to Getting Started in the Tax Industry as an Entrepreneur

Opening your own business can be a rewarding and lucrative venture, especially for those with…

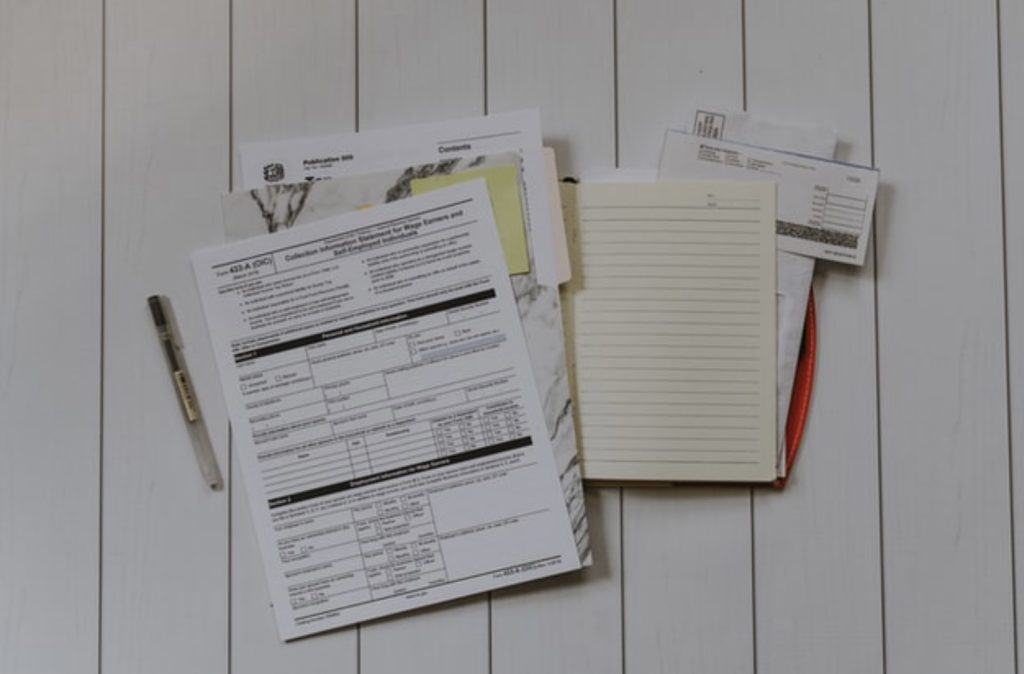

Specializing in Tax Relief: Helping Individuals and Businesses with IRS Issues

We explore the niche of tax relief services, the common issues clients face, and the…

Marketing Strategies for New Tax Businesses

The following article explores key marketing strategies that entrepreneurs in the tax industry can use…

Prestige Tax Office On Deductions and How to Maximize Your 2021 Taxes

Last year, the COVID-19 pandemic significantly impacted many aspects of day-to-day life in the US,…

A New Normal for Professional Tax Preparers

Over the last few years, there’s been much debate over whether there are enough regulations…

Tax Industry News for Practitioners

The tax services industry is a considerable part of the U.S. economy, with new tax…

Everything You Need to Know About a PTIN

A Preparer Tax Identification or PTIN was a creation of the Internal Revenue Service…

Prestige Tax Office Discusses How to Start Your Own Tax Business

Office workplace with laptop, notebook, hand, office supplies, on gray background….

Prestige Tax Office — COVID Unemployment Income Tax Liability

For the nearly 60 million Americans who filed for unemployment benefits in 2020, tax season…